Corporate Finance

Includes any decisions made by a business that affect its

finances. Three major decisions: Investment, Financing, Dividend decision. We will focus on SME/Start-up.

Start-Up Financing

Access to finance for startup firms has always been an issue of debate within the circle of Economists and Researchers. Issues related to the capital structure decision have attracted lot of attention, because of the reason that these issues are primarily dominant in small size and young firms.

Startup firms face restricted access to finance which acts as the main barrier to their growth. There are different types of financing options that are available for the startup firms. There are two types of startups analyzed in this paper:

- The startups that are yet to start their business operations or the (pre- startup) stage and

- The firms that are already in operating phases but are considered to be still in the startup stage of the firm life cycle.

Different sources of finance are explained for both types of the startups along with their advantages and disadvantages. The financing options that are available to these startup firms along with their pattern and duration of availability.

The main concern for these startup firms is not only limited up to the fact that how these sources of finance are successfully acquired but also how these sources are effectively implemented once they are made available, since the startup firms lack both the experience and expertise in dealing with the core business operations. At Bizindo, we try to solve the two important questions at SME/Startup firms:

- “What are the main sources of finance for Startup firms?”

- “What are the financing patterns for startups across the world?”

Bizindo Approach for Financing SME/Start-Up

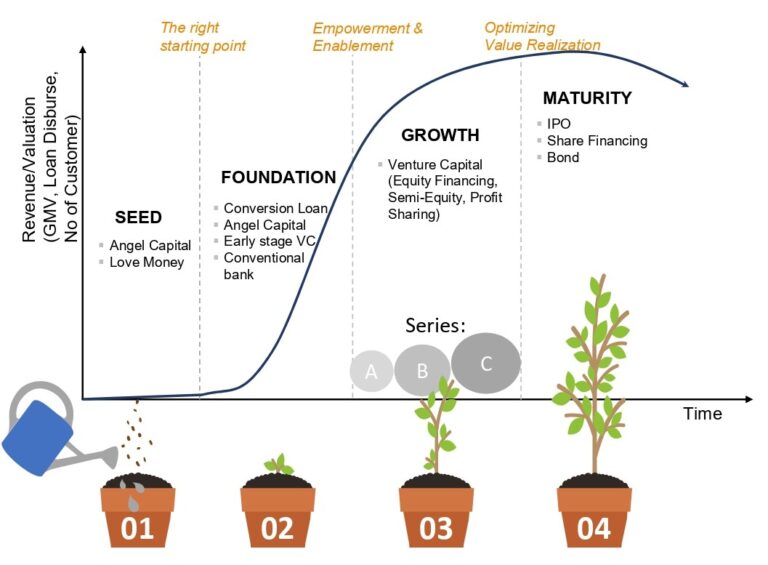

Just like the products, firms also follow the same life cycle. The firm life cycle is divided into four different stages. Each stage has its own prescribed characteristics. The different stages of the firm lifecycle are Birth or Startup stage, Growth stage, Maturity Stage and finally the Decline or Revival stage.

The importance of the types of financing can be explained by the findings that about 23.7% of startup firms disappear within the first 2 years and further 52.7% are vanished in a time span of 4 years and the major reasons behind their failure are the bankruptcy, owner’s health, and access to financing options.

For any firm in the startup stage it is necessary to make sure the availability of finance exists in order to meet the initial needs by the entrepreneurs. In the initial stages when an entrepreneur decides to convert an idea into a business opportunity, he/she might lack financial resources to cover up the requirements. At that point, Seed financing is required in order to help the entrepreneur to develop the business concept.

First round financing is crucial since it decides the fate and the direction of the startups. The second round financing is required when the startup firms needs to expand its core activities or operations. This type of financing is required for the second types of startups where additional finance is needed to expand firm’s operational activities.

Finally Mezzanine financing is another type of financing tool, where finance is needed for the marketing expenditure, expansion projects and for the improvement in products and services of the startup firm. Mezzanine finance is usually obtained through debt in the form of warrants. Mezzanine finance is usually available in the later stages of the startup firms and to all the types of firms, it is considered to be an important source of finance for the startups in their later stages along with Venture capitalists and Strategic investors.

Corporate Finance Solution:

We offer clients strategic advice and assistance across a full range of corporate finance services, including:

- Corporate Valuations

- IPOs and capital raisings

- Leveraged buy-outs

- Mergers & Acquisitions

- Private equity transactions

- Strategic options analysis

Get a Quote for Corporate Advisory & Solution in Indonesia

Kindly fill in the form below, our consultant will get in touch as soonest.

Alternatively you can call at +62 815 629 0000 or email to [email protected]

South Quarter, Tower B, Mezzanine Level, Jl. R.A. Kartini Kav. 8, RT.10/RW.4, Cilandak, Jakarta 12430

Ph: +62 815 629 0000

Payment :

Follow us :

20% off today. Whatsapp us!

20% off today. Whatsapp us!